The Business Benefits of Offering Homeowner Financing to Your Clients

Due to rising costs, many potential clients are worried that they simply cannot afford home improvement. This is why contractor financing has become a hot topic in the home improvement industry: 65% of projects over $5K are financed. It is crucial for contractors to offer financing, since approximately 25% of home improvement customers who finance are interested in financing through their contractor. Also, according to a recent survey completed by MarketSharp, 50% of home improvement contractors have been seeing an increase in demand for financing firsthand.

What does it mean to offer financing?

Financing is offering loans and other payment options as a way to fund a large purchase. All business is then conducted as usual with the repayment being done as agreed by all involved parties. Offering financing can be a strategic business approach to make your products or services more accessible to a broader range of customers who might not have the full upfront funds available for a purchase.

How does customer financing work?

Typically, financing involves filling out an application and undergoing a credit check to receive a loan from the financing party. This application typically includes personal and financial information, such as income, employment history, and credit history. This loan is to be repaid, usually with interest, at a later date.

Interested in offering financing to your clients?

Joist & Acorn Finance can help.

Pros & cons of customer financing

Customer financing is a convenient way of funding a large or otherwise unaffordable purchase. It can be extremely helpful and get home improvement customers started on their way to better financial security. However, as with most finance-related activities, you need to be aware of the risks involved.

Pros

- Studies have shown that financing increases close rates by 18% and job sizes by 30%.

- Customers are more inclined to pick better products when financing is involved in the process, leading to more revenue.

- Financing builds loyalty and customer satisfaction, leading to repeat customers and referrals, which then leads to more customers.

- Gain a competitive edge over rivals. Home improvement financing is a new concept in the industry so you can get ahead of the competition by offering it now.

Cons

Some of the downsides you may encounter during the financing process are:

- Lenders charging fees

- Minimum amounts for loans

- Navigating different laws depending on the state where the contracting is taking place and type(s) of financing being conducted.

- Companies who use methods that are not governed by financial law, leading to higher costs than expected

- You will be risking taking on debt if a customer falls behind on their payments

What are my customer financing options?

There are multiple ways to offer customer financing. Due to this abundance of financing options, it can become tough to know which method to use. It is important to find the best method for you and your customer.

Lender financing

Lender financing for contractors involves securing financial support directly from external sources, such as banks, credit unions, or specialized lending institutions. Lender financing typically involves quicker repayment and loans that are smaller than those in third-party financing.

Third-party financing

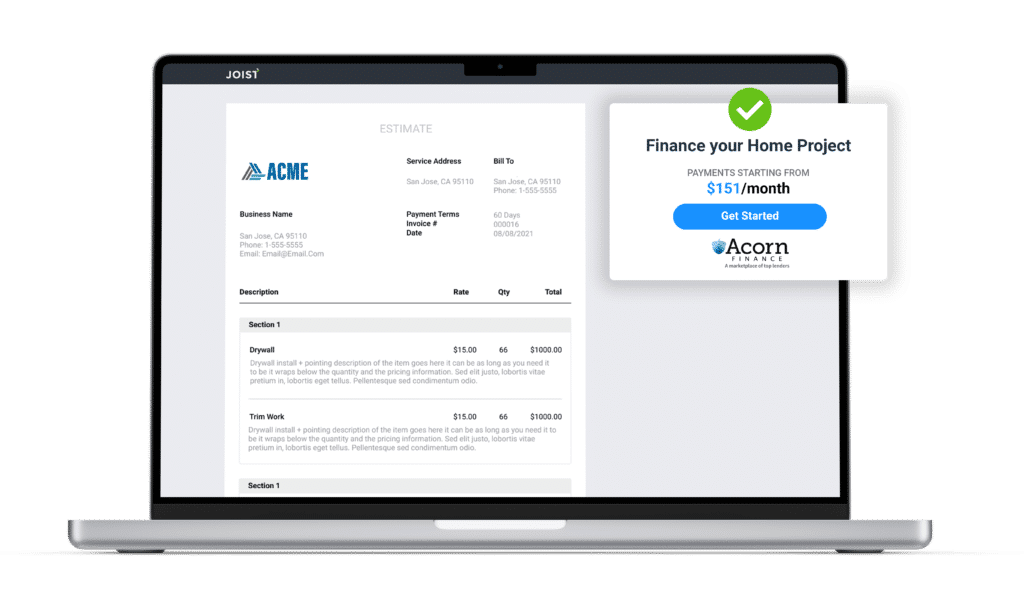

Third-party financing means that there is a vendor who works with the lenders to offer loans to the customers. You will not be directly working with the bank who provides the loan, rather you will outsource this part of the job to a third party. This can be accomplished automatically through integration, such as Joist’s integration with Acorn Finance.

BNPL (Buy Now, Pay Later)

In BNPL financing, the client pays back the loan in affordable monthly payments with no interest. BNPL financing is preferable for smaller loans, which are usually no more than $1,000. PayPal offers this kind of financing.

What is the best way to offer financing as a contractor?

There is no one “best way” of offering financing as a contractor. It all comes down to the needs of you and your customer. Here are some factors to consider when deciding on an optimal provider:

- No upfront costs

- Widespread coverage options

- Reasonable minimum

- Integrates with your estimating & invoicing system

- Reasonable interest rates

- Clear communication; try to avoid sneaky jargon

- No hidden fees or surprises

Tips for talking about financing with your customers

Broaching this topic with your customers can be daunting. Here are some ways to talk about it with your customers:

Initially bringing up the idea of financing is hard. Try to pepper your speech with the idea instead of pitching it separately. Talking about financing options throughout the sales pitch will make it feel like a more natural part of the home improvement process.

Refer to it as payment options because customers might respond negatively to the term “financing”. You can then include these payment options on the invoice or estimate, bringing the topic directly to the customer as a regular part of the payment process. Remember to include FAQ materials as well. Be prepared for the customers to ask questions about financing options.

It is also important to keep it simple at first. Don’t get into the details immediately, and especially not before the customer has shown an interest in financing. You don’t want to scare them off with too much technical talk or make them feel pressured into it. Potential customers like to understand everything they are getting into when it comes to any type of financing situation.

Interested in offering more payment options to your clients?

Joist & Acorn Finance can help.