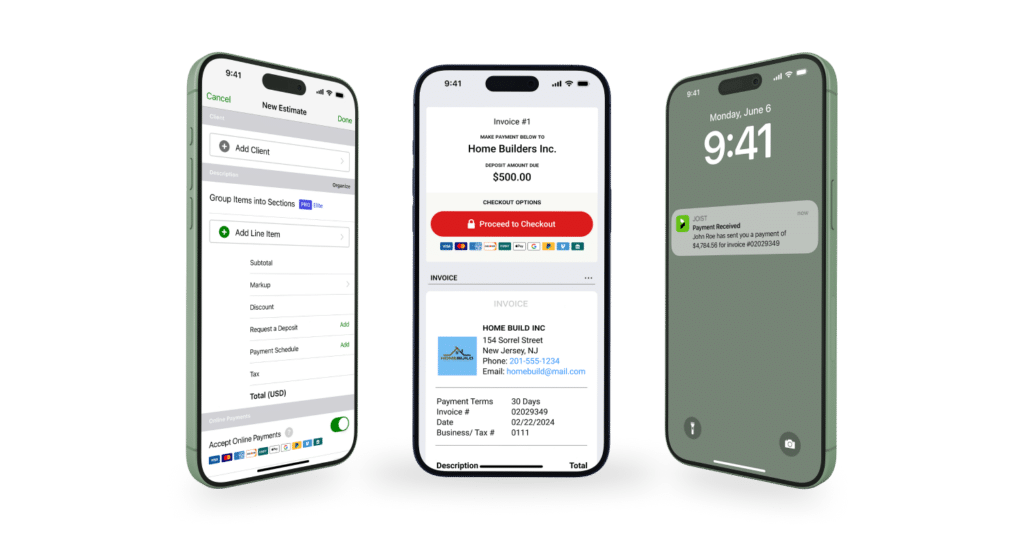

Let Your Clients Pay How They Want

Easily accept credit, debit, or flexible online payment options.

Enable Payments in your Joist App Settings to securely and conveniently accept payments by credit card, PayPal, or Venmo (US Only). You’ll cut cash flow delays and be able to collect payments straight from click-to-pay invoices.

Offer Your Clients the Convenience of Paying Online

Clients can easily pay online from a phone or laptop straight from your invoices. It’s easy to use for both you and your client, and you’ll spend less time tracking down and following up on payments, invoices, and disputes once the job is complete.

Fast Payouts Directly to Your Bank Account

Get payouts from Joist Payments transactions directly to your bank account in as little as two days. Clients can pay the job deposit online right from your estimate or invoice to help you save time and simplify your sales process.

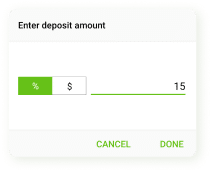

Cover Transaction Fees

Joist Payments makes it easy to cover fees with simple, one-click markup tools. Protect your profits while still offering your customers convenient ways to pay.

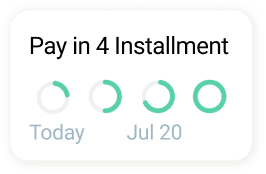

Increase your sales with “Buy Now Pay Later”

Give clients the option to pay their invoices in four installments, while you get paid on-time and in full. They will see a ‘Pay Later’ button, allowing them to pay in short-term, interest-free payments at checkout with no additional cost to you.

Instant Payouts

If you need your PayPal balance transferred to your bank as soon as possible, PayPal lets you do just that! Transfer your money instantly for just $10 (or for as low as 1% for amounts under $1,000).

PayPal Debit Card*

Instantly access your PayPal balance with a MasterCard debit card (*In the US only, no monthly fee and no minimum balance required).

Win More Jobs with Online Deposits

Clients can pay the job deposit online right from your estimate or invoice to help you save time and simplify your sales process.

Start Collecting Payments for Your Work

Frequently asked questions

Will I automatically receive money directly into my bank account or will I have to go to the PayPal dashboard every time to transfer funds?

Once you activate Automatic Withdrawal from your PayPal account, you will receive automated daily payouts directly to your bank account without the need to go to the PayPal dashboard.

How long does a payment take to get to me?

When a client pays you through Joist Payments, the balance (minus the transaction fee) often appears in your PayPal account right away, and you can generally expect to see the funds to transfer into your bank account within 2 business days.

Do my clients need a PayPal account to pay me?

No, your clients will be able to checkout without having their own PayPal account.